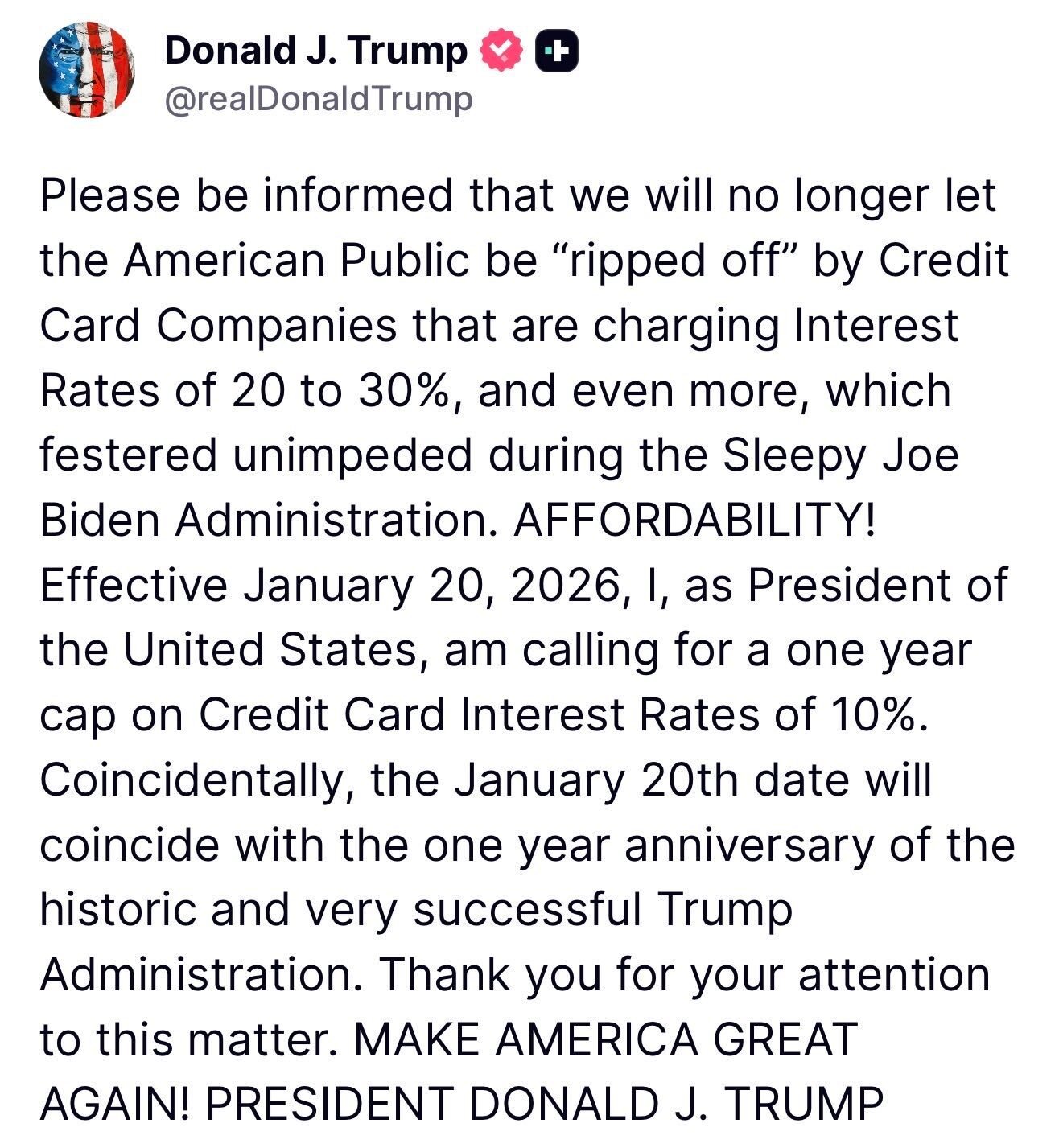

U.S. President Donald Trump has called for a one-year cap on credit card interest rates at 10 percent, aiming to ease borrowing costs for American consumers. The proposal was shared on his Truth Social platform on January 10, 2026, ahead of the one-year mark of his current administration.

Eko Hot News reports that Trump criticised credit card companies for charging rates as high as 20 to 30 percent, describing it as unfair to cardholders. He emphasised that the cap would protect ordinary Americans from excessive debt burdens while promoting affordability.

Analysts note that the proposed cap cannot be implemented through an executive order alone and requires Congressional approval before it can become law. Lawmakers must pass enabling legislation for the plan to take effect.

Major industry groups, including the Consumer Bankers Association and the American Bankers Association, have opposed the measure. They argue that a strict 10 percent cap could reduce access to credit and push consumers toward higher-cost alternatives.

Eko Hot News also notes that bipartisan efforts on interest rate caps have occurred in the past, with senators such as Bernie Sanders and Josh Hawley introducing related bills, though no legislation has yet become law.

Critics highlight that Trump’s previous administration had rolled back certain consumer protections, such as late fee limits, raising questions about the feasibility and enforcement of the new proposal. Supporters view it as a response to rising living costs and financial strain on households.

The announcement aligns with broader initiatives from Trump aimed at addressing consumer affordability, including proposals on mortgage rates and other lending reforms. Experts warn that while the idea may gain public support, practical implementation depends on legislative collaboration and political negotiation.

Observers expect the proposal to ignite debates among policymakers, consumer advocacy groups, and financial institutions over its potential economic impact and long-term effects on the U.S. credit market.