Lagos State’s landmark Lagos 200 billion bond issuance has made history, as investors oversubscribed the offer by a wide margin, signalling robust confidence in the state’s fiscal direction.

Eko Hot News reports that the dual issuance—a ₦200 billion Conventional Bond and a ₦14.8 billion Green Bond—drew exceptional interest from both local and international investors, further solidifying Lagos State’s rising reputation as a dependable investment destination.

Lagos State has concluded the book-build process for its monumental bond programme, marking a significant milestone in Nigeria’s domestic debt market. With the state putting forward a ₦200 billion Conventional Bond and a ₦14.8 billion Green Bond, the response from investors surpassed even the most optimistic expectations. The Lagos 200 billion bond alone attracted a remarkable ₦310 billion in subscriptions, representing a 55% oversubscription rate. This makes it the largest non-corporate, sub-national bond ever issued in the country’s financial history.

Similarly, Lagos State’s ₦14.8 billion Green Bond—its first-ever impact-focused climate bond—recorded a near 100% oversubscription. With a subscription volume of ₦29.29 billion, demand exceeded the target by 97.7%. This achievement positions Lagos as a pioneer among Nigeria’s sub-national governments in leveraging sustainable financing to drive climate-resilient development.

According to Governor Babajide Sanwo-Olu, the massive investor turnout reflects not only confidence in Lagos but also the renewed optimism surrounding Nigeria’s macroeconomic outlook. He attributed part of this resurging trust to the reforms initiated by President Bola Ahmed Tinubu, noting that the Federal Government’s recent Eurobond issuance was similarly oversubscribed. The governor described Lagos’ success as a demonstration of synergy between national economic policy and sub-national financial innovation.

“This is a reflection of the global confidence in Nigeria’s economy, fostered by the bold reforms initiated by President Bola Ahmed Tinubu GCFR, as reflected in the recent oversubscription of the Federal Government’s Eurobond,” Sanwo-Olu said. “In Lagos, ours is a testament to our resilience and the unwavering support of our private-sector partners who believe in our vision of building Africa’s model megacity that is safe, secure, and functional.”

Governor Sanwo-Olu reiterated that his administration remains committed to prudent financial management, accountability, and fiscal transparency. He emphasised that Lagos State is determined to attract more investment by ensuring a stable and conducive environment for business growth. His long-term vision, he noted, is to position Lagos among the leading global financial hubs.

The proceeds of the Lagos 200 billion bond and the green bond are expected to drive transformative development under the THEMES+ Agenda. THEMES+—which stands for Transportation and Traffic Management, Health and Environment, Education and Technology, Making Lagos a 21st Century Economy, Entertainment and Tourism, Security and Governance, plus Social Inclusion—has become the guiding framework for Lagos’ overarching development strategy.

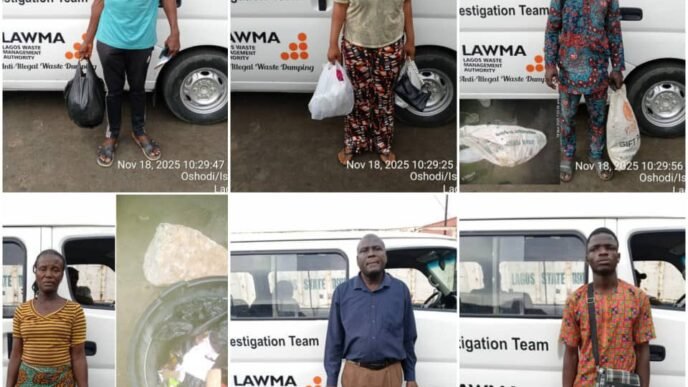

Projects earmarked for funding include urban transportation upgrades, expansion of road infrastructure, strengthening of the health system, improvements in the education sector, and key environmental sustainability initiatives that align with global climate-resilience standards. The Green Bond, in particular, will support eco-friendly projects aimed at mitigating environmental risks, enhancing waste management systems, and improving green transportation.

Commissioner for Finance, Hon. Yomi Oluyomi, commended the investment community for demonstrating unwavering faith in Lagos’ governance and economic prospects. He noted that the level of participation reflects investors’ confidence in Lagos State’s robust credit profile, long-term development strategy, and strong debt management record.

Financial experts view the oversubscription as a positive signal for sub-national financing in Nigeria. As Lagos charts a successful path in attracting large-scale capital for infrastructure development, other states may be encouraged to explore innovative financing channels to fund their public projects. Analysts also believe that the dual issuance will strengthen Lagos’ financial market ecosystem, broaden its investor base, and create more opportunities for public–private collaboration.

Lagos’s emergence as the first Nigerian sub-national to issue a climate-oriented green bond marks a turning point in sustainable financing. It aligns the state with global trends, where cities and regional governments increasingly raise funds through green instruments to tackle climate challenges and transition to low-carbon economies. By adopting this approach, Lagos is positioning itself not only as Nigeria’s economic nerve centre but also as a forward-looking city committed to long-term environmental responsibility.

As the Lagos 200 billion bond ushers in a new chapter of transformation, stakeholders expect the funded projects to stimulate economic activity, create jobs, enhance social services, and improve the quality of life for millions of Lagos residents. With strong investor backing and a clearly defined development blueprint, the Sanwo-Olu administration appears set to deliver large-scale, high-impact initiatives that reflect the aspirations of Africa’s fastest-growing megacity.

The overwhelming reception from investors underscores a simple truth: Lagos State’s financial credibility is strong, its development projections are trusted, and its commitment to sustainable growth continues to resonate both nationally and globally.